non filing of income tax return notice under which section

Complete Lines 1 4 following the instructions on page 2 of the form. Once received you need to respond to it within 15 days from the date of receiving the notice.

How To Respond To Non Filing Of Income Tax Return Notice

Under section 1421 the Assessing Officer can issue notice asking the taxpayer to file the return of income if he has not filed the return of income or to produce or cause to be produced such accounts or documents as he may require or to furnish in writing and verified in the prescribed manner information in such form.

. Download IRS Form 4506-T. Is your 10-digit customer number. We see no justifiable reason to interfere with the order under challenge.

However we clarify that when a notice under Section 148 of the Income tax Act is issued the proper course of action for the noticee is to file return and if he so desires to seek reasons for issuing notices. You get a defective return notice under section 139 9 of the Income Tax Act. Please prepend a zero to your student ID ie.

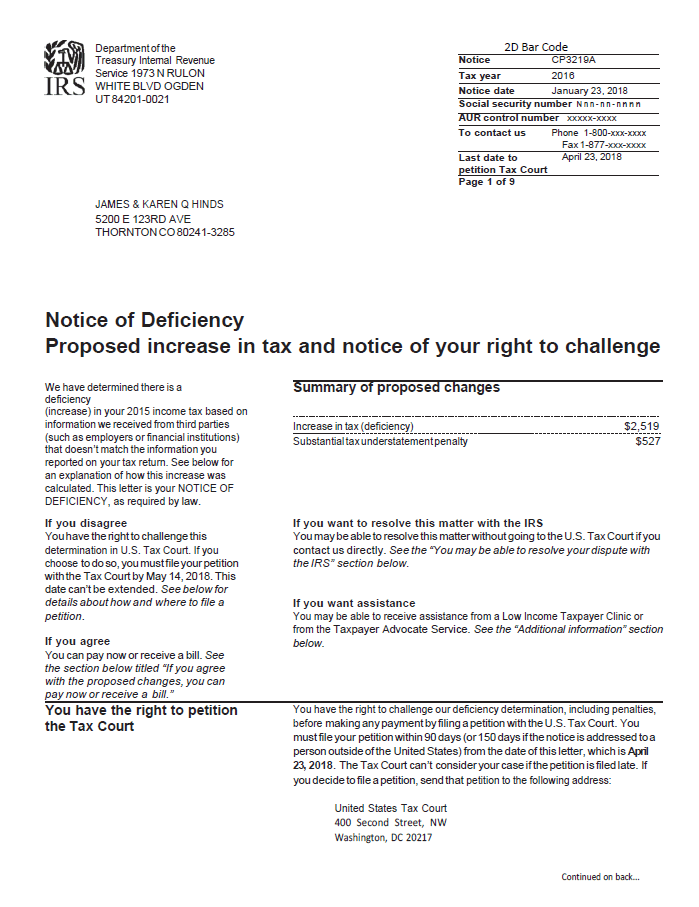

Select the checkbox on the right hand side for Verification of Nonfiling. Internal Revenue Code Section IRC 6212 authorizes the Service to send a notice of deficiency when a taxpayer appears to have a filing requirement but does not comply by voluntarily filing a tax return. In the given facts ITAT find that there was a reasonable cause with.

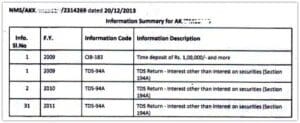

Income tax notice us 1421 is sent if you have not filed the return or if the returns are incomplete. Notice for Tax Credit Mismatch. Notice for Non-Disclosure of Income.

If the assessing officer feels some income has been missed a notice is sent under this section as the income will need to be reassessed. Using an automated system the Automated Underreporter AUR function compares the information reported by third parties to the information reported on your return to identify potential discrepancies. Compliance Income Tax Return filing Notice This notice is sent to people by the Income Tax Dept if they think that the person has some taxable income but the ITR has not been filed for such income.

652 Notice of Underreported Income CP2000. In case if you have already filed income tax return but not declared correct tax liability pay due taxes and file revised return. This notice is about some dues which the tax payer owes to the department.

If Information is correct file income tax return after paying due taxes and. The assessing officer is bound to furnish reasons within a reasonable time. 50 of the total tax payable on the income for which no return was furnished.

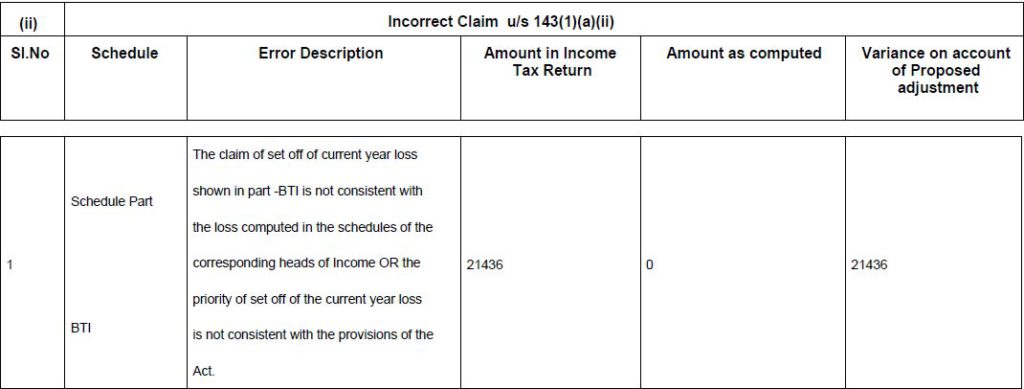

Now it is important to understand that notice under section 1431 and 1431a are two different. A person with taxable income fails to file his ITR or is found to under-report his income in the returns. Notice for Non-Filing of Income Tax Return.

The issue of a notice under section 148 of the Income-tax Act the Act calling upon the Taxpayer to file a return of income for the year specified in the notice is the starting point of the Re-assessment Re-audit proceedings. A Re-assessment proceeding also referred as re-opening of the assessment is initiated by the assessing officer when he has reasons to. Submit a response to notice us 143 1 a by reporting the Acknowledgement Number of Revised ITR.

Many taxpayers have received notice under section 1431a after filing their Income-tax returns for AY 2017-18 or AY 2018-19. Non-filing of Income Tax returns is an unlawful act and can attract serious consequences to the tax-payer. In case you are not liable to file return submit online response under Response on non-filing of return on Compliance Portal.

Notice for Non-Payment of Self Assessment Tax. If you have been filing. The IRS receives information from third parties such as employers and financial institutions.

Under section 1421 the Assessing Officer can issue notice asking the taxpayer to file the return of income if he has not filed the return of income or to produce or cause to be produced such accounts or documents as he may require or to furnish in writing and verified in the prescribed manner information in such form. If you do not file the income tax return in the correct form you will receive a defective return notice from the income tax department. Rs10000-Rs100000 besides the late filing penalty under Section 234E which is Rs200day till the TDSTCS is paid.

Section 142-1 of income tax act. The Income Tax Dept collects information through various sources and then based on their own analysis send notices to people who have carried out specified transactions. B To file Revised Return for notice us 139 9 Prepare Revised Return after rectifying the errors and defects - TDS Mismatch ITR filed without PL and Balance Sheet ITR filed with tax dues ITR filed without tax audit report.

If the Income Tax return is not furnished by the assessee within the timeframe underlined in the notice issued under Section 148 by the presiding Assessing Officer the assessee shall be made to pay interest under Section 2433 for late filing of Income Tax return or for not filing of Income Tax return if the income has already been determined under Section. Notice Under Section 1421. Section 273B provides that no penalty shall be imposed inter alia us271F where the assessee establishes a reasonable cause for failure referred to in said section.

Contact us for ease in filing returns. Notice for Delayed ITR Filing. Section 1432 Notice under this section is received after a detailed enquiry has been done by the assessing officer.

Even if you have genuine reasons for not filing the income tax returns like your income for the financial year being under the basic exemption limits due to loss of job or less profits booked in business it is still recommended to file income tax returns.

Non Filing Of Income Tax Returns Despite Earning Taxable Salary Kindly Refer To The Subject Noted Above 2 Section 1 Income Tax Return Income Tax Tax Return

Irs Notice Cp80 The Irs Hasn T Received Your Tax Return H R Block

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

20 1 9 International Penalties Internal Revenue Service

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

What Is A Cp05 Letter From The Irs And What Should I Do

Irs Audit Letter Cp2501 Sample 1

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

It Notice For Proposed Adjustment U S 143 1 A Learn By Quickolearn By Quicko

How Should You Respond To A Defective Income Tax Return Notice Under 139 9

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of Income Tax Return Notice

Irs Tax Notices Explained Landmark Tax Group

How To Respond To Non Filing Of Income Tax Return Notice